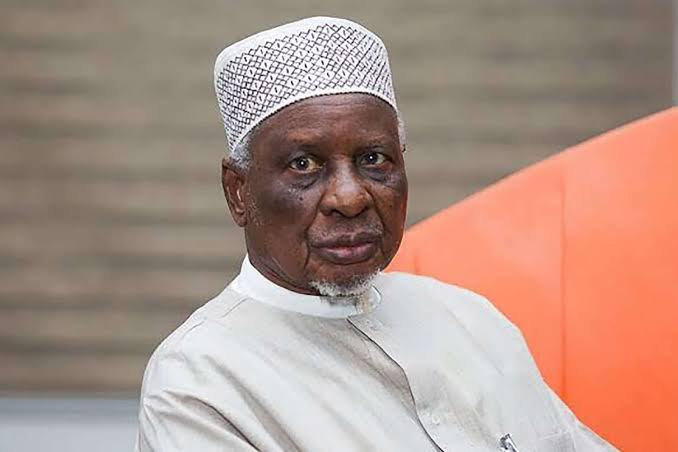

Presidential election: Tanko Yakasai tells Peter Obi to be patient

Tanko Yakasai, a Nigerian politician and human rights activist has told the presidential candidate of the LabourParty, Peter Obi, that politics is not learnt in school but a continuous process.

Yakasai, a former Liaison Officer to former President Shehu Shagari and a founding member of ArewaConsultative Forum, ACF, said this after Peter Obi addressed the press in Abuja for the first time after the announcement of the presidential election result by the Independent National Electoral Commission, INEC, on Wednesday morning.

Obi told the press that he was heading to the court, claiming he has the necessary proof to defend that he actually won the 2023 presidential election and that his mandate was stolen.

Speaking on Arise Television, Yakasai said that Obi must learn to be patient, adding that the former Anambra State helmsman is just new in politics.

“He was a banker and now a politician. He is contesting election for the first time and it is in process. I plead with him to be patient enough,” he said.

According to Yakasai: “You don’t learn politics in school.You learn through [the] process and I’m sure he’ll be a good politician and be successful if only he can endure. In this kind of situation, you see people speaking from different perspectives.

“If somebody is not happy with the outcome of the election you don’t expect him to praise the process but it’s another matter if you ask another person. I’m not surprised.”