The emerging digital disruptions in the global financial ecosystem pose no threat to the over 128 million bank accounts in Nigeria, the Nigeria Deposit Insurance Corporation (NDIC) has said.

According to the Corporation, the accounts in Nigeria’s deposit money banks grew from 83.0 million in 2016 to 99.1 million in 2017; then 112.0 million in 2018 to 128.4 million in 2019. Nigeria has 32 deposit money banks, six merchant banks and three non-interest banks. There are also 875 microfinance banks.

Digital disruption is the change that occurs when new digital technologies and business models affect the value proposition of existing goods and services. Example is the introduction of Financial Technologies (FinTechs) and the tools employed to drive financial inclusion, such as bank products, Internet banking and Bank Verification Number (BVN).

Financial Technology (FinTech) refers to the use of software and digital platforms to deliver financial services with disruption to established business models by creating new and efficient means of providing services.

Technology is a key driver of rapid changes in the banking industry. As technology enhances the quality of existing banking services and/or facilitates the introduction of new ones, so also are the expectations of the banking public getting increasingly more complex.

Banks play financial intermediation roles by mobilising deposits from the surplus units and lend to the deficit units, thereby facilitating economic growth and development, among other functions. This makes them, arguably, the most regulated business (enterprise) globally.

As a result, strict regulatory measures are adopted to guarantee the safety of stakeholders’ assets such as depositors’ funds, creditors’ instruments and investors’ stake. Besides being the most regulated, the banking industry is also, perhaps, the most disrupted industry today globally.

Following the effects of the global financial crisis of 2078/2008, and the disastrous fallouts of the banking consolidation of 2002, the NDIC has been repositioned to play preventive regulat0ry roles over the banks to ensure sustained financial system stability.

After the global financial crisis (2007/2008), FinTech has evolved to disrupt and reshape commerce, payments, investment, asset management, insurance, clearing and settlement of securities and even money itself with crypto-currencies such as Bitcoin.

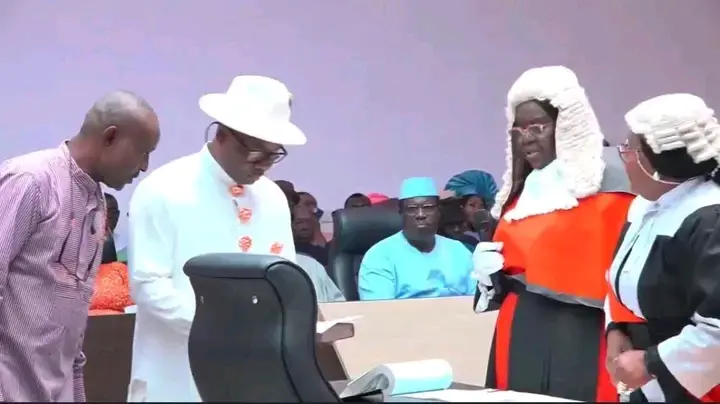

“As economies across the globe continue to grapple with the devastating impact of the COVID-19 pandemic, it has become expedient and highly desirable, for supervisors to come up with appropriate strategies that are required to build resilience into our financial system as we seek to provide the much-needed support to the Federal Government’s economic recovery agenda,” said Bello Hassan, Managing Director/Chief Executive of NDIC at a capacity building session for financial media professionals recently.

Outlining the measures taken by the corporation towards achieving its mandate, Hassan stated that the management had ensured that adequate coverage was provided for depositors and accounts as the number grew exponentially over the years. He also allayed fears being expressed by Nigerians over the safety of their deposits in the different categories of financial service institutions, stressing that adequate provision had been made to safeguard their assets.

Hassan said much of the concerns were based on lack of adequate understanding of the factors underlying the coverage of the prescribed limits, adding that Nigeria’s regulatory deposit framework is judged the best in the world.

“Much of the concerns are predicated on the lack of adequate understanding of the principles, rationale and realities that informed the determination of our coverage limits. It is in that respect that we urge the media through this forum to make Nigerian depositors aware that the NDIC’s maximum coverage limits of N500,000.00 per depositor per commercial, merchant and, non-interest bank, primary mortgage bank and mobile money operator, as well as N200,000.00 per depositor per microfinance bank remain the most adequate and robust in the world,” he said.

One of the tools is the Deposit Insurance Scheme (DIS). This is a key safety net initiative with the key objective of ensuring banking system safety and stability through depositor protection

As a key safety net initiative, a DIS is required to have robust resilience and reinvention strategies in place all the time but most especially during this period of extreme disruptions in the banking industry, globally.

Banking system safety and stability will facilitate the effectiveness of the financial intermediation function of banks. Effectiveness of the financial intermediation function of banks also depends on sound risk management by individual banks and strong prudential regulation and supervision.

Other measures include prudential regulation and supervision. These would ensure soundness of the individual banks (and financial system stability), sound market conducts and consumer protection.

Today, digital disruptions in the form of payment solutions, lending and savings facilitations are transforming the banking industry. In response to these, banks and other financial institutions are forced to either partner with Financial Technology (FinTech) companies or develop their own solutions.

This marriage or convergence of financial services and transformation technology is reshaping the financial services industry.